Planning for the future can be daunting, but, ensuring your loved ones are economically supported even after you're gone brings peace of mind. Life insurance in Ohio provides a safety net, offering financial protection to your family when faced with unforeseen circumstances. With various kinds of policies available, finding the ideal coverage to meet your needs and budget is crucial. Consider factors like your age, health status, and desired amount of protection.

- Ohio's insurance market provides a extensive range of reputable insurers.

- Speak with a licensed agent to discuss your specific needs and explore available options.

- Regularly examine your policy to ensure it still accommodates your evolving requirements.

Locating a Reputable Life Insurance Agent in Ohio

Planning for the future is vital, and choosing the right life insurance policy may to safeguarding your loved ones' financial well-being. In Ohio, there are numerous life insurance agents available. However, choosing a reputable agent that you feel comfortable with is essential.

Let's delve into determining a trustworthy life insurance agent in Ohio:

* **Check their credentials:** A reputable agent will be licensed by the Ohio Department of Insurance. You can verify their credentials on the department's website.

* **Look for experience:** Time spent in experience in the insurance industry is a valuable indicator. An experienced agent will have expertise of different types of policies and assist you in making the best choice for your needs.

* **Read online reviews:** Online reviews can provide valuable insights about an agent's reputation. Pay attention to both positive and negative reviews.

* **Ask for referrals:** Reach out to friends, family, or colleagues for referrals to reputable life insurance agents in Ohio.

* **Schedule a consultation:** Meet with several agents to discuss your needs. This will give you a chance to gauge their professionalism.

Remember, choosing the right life insurance agent is an important decision. Do your research to discover an agent who is trustworthy and can help you obtain the coverage you need.

Understanding Life Insurance Options in Ohio

Navigating the world of assurance can be a daunting task, especially when you're facing unique needs like those found in Ohio. Ohio residents have a broad selection of life insurance products available to them, each with its own set of benefits. website Whether you're seeking term life insurance or permanent options, understanding the different types is essential to making an informed choice.

Consider by determining your unique needs and budgetary goals.

Consider factors like your household, existing obligations, and anticipated expenses. Once you have a precise understanding of your demands, you can start to explore the diverse of life insurance products available in Ohio.

Remember, consulting a qualified plan specialist can provide valuable recommendations tailored to your situation. They can help you interpret the complexities of life insurance and discover the best coverage option for your personal situation.

Protecting Your Financial Legacy with Ohio Life Insurance

In the face of unanticipated events, securing your family's future demands careful planning. Ohio life insurance offers a reliable safety net to protect your loved ones from financial hardship should the unthinkable occurs. By purchasing a policy, you can provide your family with the monetary foundation they need to succeed. Research the numerous types of life insurance available in Ohio, such as term life and whole life, to identify the option that best addresses your unique needs and objectives.

- Speak with a licensed insurance agent in Ohio to gain personalized advice on choosing the right policy for your needs

- Evaluate quotes from several reputable insurers in Ohio to discover the best value and coverage

- Periodically review your life insurance policy to confirm it still fulfills your evolving needs

Obtain a Free Quote for Life Insurance in Ohio Today

Looking to secure your family's future? A reliable life insurance policy is an essential step in ensuring their economic well-being. In Ohio, you can swiftly get a free of charge quote to understand your options and find the best coverage for your needs.

Don't wait until it's too late. Speak with our knowledgeable agents today and let us assist you through the process of finding the right life insurance policy for your situation.

Secure Life Insurance Solutions for Ohio Residents

Finding the perfect life insurance policy can feel overwhelming, especially in a state like Ohio with its diverse needs and demographics. But don't worry! There are plenty reliable options available to shield you and your family. Whether you need whole life insurance, or have individual circumstances, an experienced consultant can help you navigate the details of choosing the best solution.

It's important to compare quotes from various insurers and analyze the conditions of each policy. Don't be afraid to ask questions and request explanation until you feel assured about your choice.

Remember, life insurance is an asset that can provide financial security for your dependents. By taking the time to research your options and working with a competent agent, you can find a solution that meets your needs and covers your future.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Jonathan Taylor Thomas Then & Now!

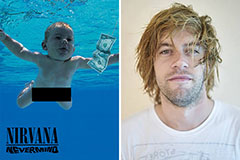

Jonathan Taylor Thomas Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!